Take-Two отчёт компании TTWO NASDAQ

Шестого февраля 2023 года компания Take-Two Interactive Software Inc (NASDAQ: TTWO) отчиталась о финансовых результатах и поделилась своими прогнозами с инвесторами.

Результаты отчёта оказались вполне ожидаемыми. Компания уверенно чувствует себя среди аналогичных конкурентов в игровой отрасли, но доход оказался немного ниже прогнозов. При этом стабильно растут продажи основных продуктов Rockstar Games. Red Dead Redemption 2 и Grand Theft Auto V по-прежнему пользуются популярностью среди геймеров и генерируют солидные цифры продаж.

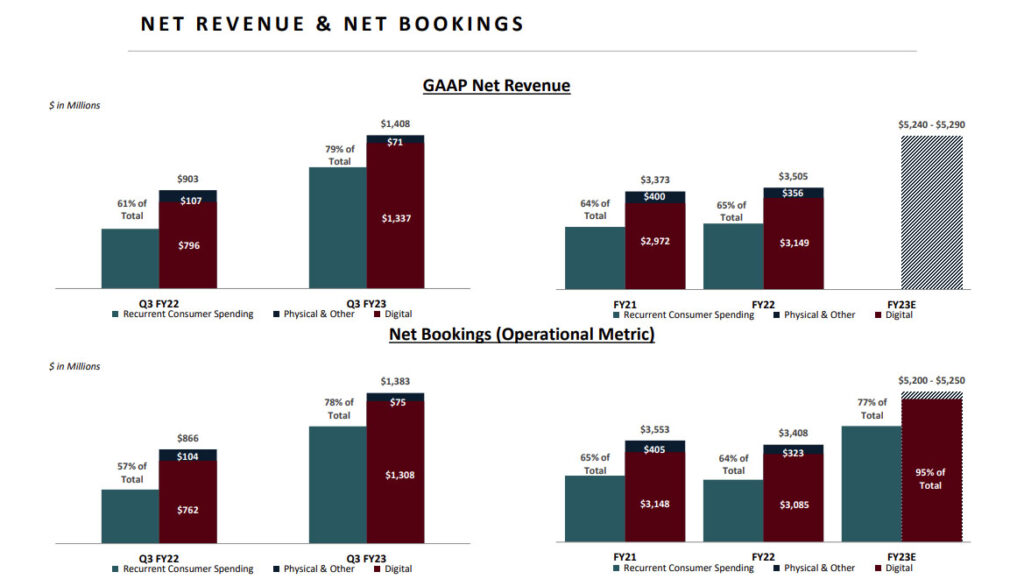

Инвесторов может не обрадовать разве что чистый убыток за 3-й финансовый квартал 2023 года. Он оказался хуже прогнозов и составляет $153,4 млн, или 0,91 цент на акцию, при чистом объеме заказов в $1,38 млрд. Аналитики считали, что чистый убыток составит 0,85 центов на акцию, а чистая выручка $1,46 млрд. Прибыль не по GAAP составила 86 центов на акцию, что ниже ожиданий на уровне 89 центов на акцию.

Компания ожидает, что в 2023 финансовом году чистая выручка составит от $5,2 млрд до $5,25 млрд, что меньше нижней границы ее предыдущего прогноза и ниже консенсус-прогноза в $5,45 млрд.

После публикации отчета бумаги компании снижались в пределах 2% на акцию.

На сегодняшний день Rockstar Games продали:

- 175 миллионов копий игры GTA V

- 395 миллионов копий всех игр серии Grand Theft Auto

- 50 миллионов копий игры Red Dead Redemption 2

TAKE-TWO INTERACTIVE

SOFTWARE, INC.

(NASDAQ: TTWO)

THIRD QUARTER FISCAL 2023 RESULTS &

GUIDANCE SUMMARY

CAUTIONARY NOTE:

FORWARD LOOKING STATEMENTS

Statements contained herein which are not historical facts are considered forward-looking statements under federal securities laws and may be identified by words such as

«anticipates,» «believes,» «estimates,» «expects,» «intends,» «plans,» «potential,» «predicts,» «projects,» «seeks,» “should,” «will,» or words of similar meaning and include, but are not

limited to, statements regarding the outlook for the Company’s future business and financial performance. Such forward-looking statements are based on the current beliefs of our

management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are

difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: risks relating to our

combination with Zynga; the uncertainty of the impact of the COVID-19 pandemic and measures taken in response thereto; the effect that measures taken to mitigate the COVID-19

pandemic have on our operations, including our ability to timely deliver our titles and other products, and on the operations of our counterparties, including retailers and distributors;

the effects of the COVID-19 pandemic on both consumer demand and the discretionary spending patterns of our customers as the situation with the pandemic continues to evolve;

the risks of conducting business internationally; the impact of changes in interest rates by the Federal Reserve and other central banks, including on our short-term investment

portfolio; the impact of potential inflation; volatility in foreign currency exchange rates; our dependence on key management and product development personnel; our dependence

on our NBA 2K and Grand Theft Auto products and our ability to develop other hit titles; our ability to leverage opportunities on PlayStation®5 and Xbox Series X|S; the timely release

and significant market acceptance of our games; the ability to maintain acceptable pricing levels on our games; and risks associated with international operations.

Other important factors and information are contained in the Company’s most recent Annual Report on Form 10-K, including the risks summarized in the section entitled «Risk

Factors,» the Company’s most recent Quarterly Report on Form 10-Q, and the Company’s other periodic filings with the SEC, which can be accessed at www.take2games.com. All

forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. The Company undertakes no obligation to update any forwardlooking statement, whether as a result of new information, future events or otherwise.

Q3 FY2023 RESULTS SUMMARY:

GAAP

FINANCIAL SUMMARY ($ in millions, except EPS)

Q3

ACTUAL GUIDANCE

GAAP Net Revenue $1,408 $1,430 TO $1,480

Operating Expenses $889 $897 TO $907

GAAP Net Income $(153) $(160) TO $(142)

GAAP EPS $(0.91) $(0.95) TO $(0.85)

Note: GAAP results were impacted by amortization of acquired intangibles and business acquisition costs

Q3 FY2023 RESULTS SUMMARY:

SELECT MANAGEMENT RESULTS

SELECT FINANCIAL DATA ($ in millions)

Q3

ACTUAL GUIDANCE

Net Bookings $1,383 $1,410 TO $1,460

Recurrent Consumer Spending

Growth (RCS)

+117% +125%

Digitally-Delivered Net Bookings

Growth

+72% +80%

Net Bookings were $1.38 billion, which was slightly below our prior

guidance

• We believe that consumers displayed more cautionary purchasing

behaviors during the Holiday season. As in prior periods of economic

headwinds, full game sales from our catalog of industry-leading

intellectual properties were relatively resilient. However, we felt pressure

on some of our newer releases that are in earlier stages of building their

player base, alongside softness in recurrent consumer spending

• RCS rose 117%. Zynga’s in-app purchases performed in line with our

revised expectations; however, this was offset by weakness in RCS for

several of our console and PC games

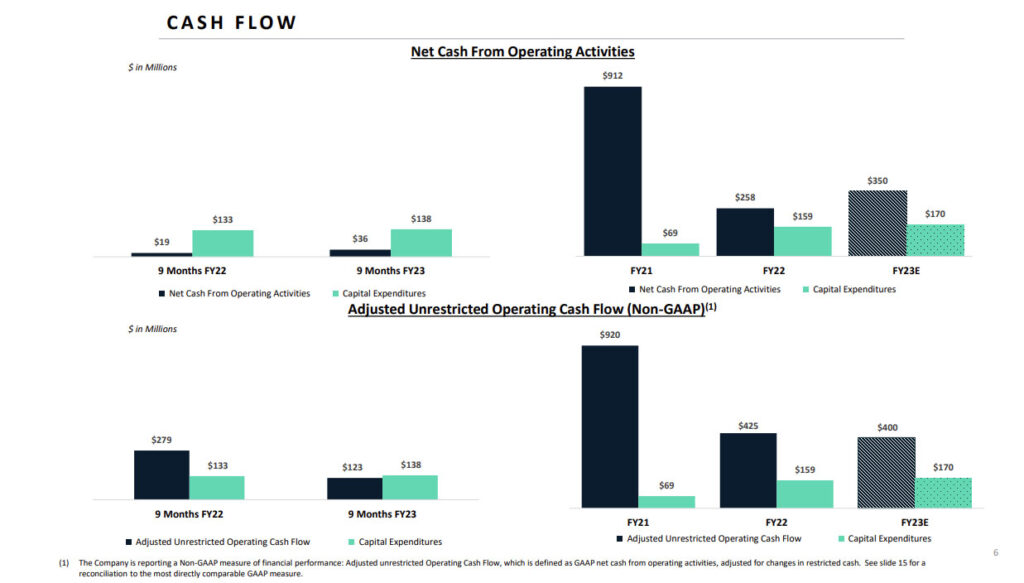

• We ended the quarter with over $1.1 billion in cash and short-term

investments and paid down $200 million of revolver borrowings,

reducing our debt to $3.1 billion

Note: Results from last year did not include Zynga business.

N E T R E V E N U E & N E T B O O K I N G S

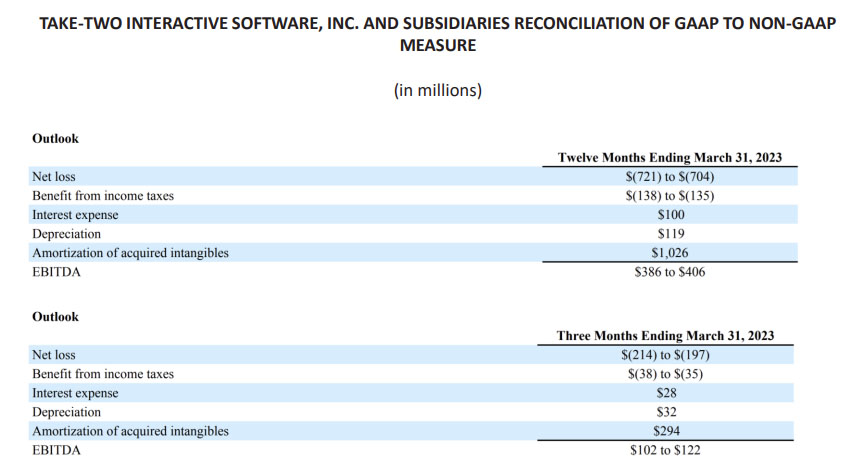

FY 2023 GUIDANCE:

GAAP

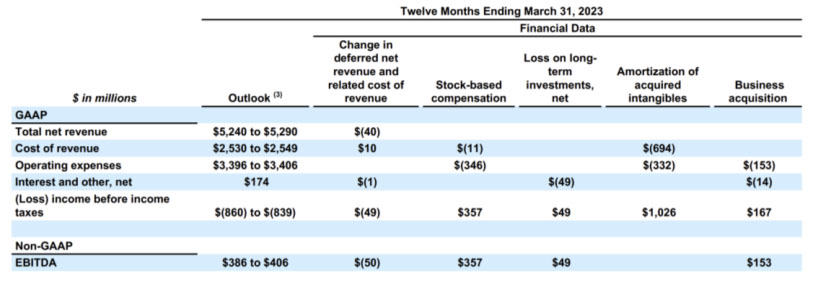

FISCAL YEAR 2023 GUIDANCE ($ in millions, except EPS)

FY 2023 REVISED GUIDANCE PRIOR GUIDANCE

GAAP Net Revenue $5,240 TO $5,290 PREVIOUSLY: $5,410 TO $5,510

Operating Expenses $3,396 TO $3,406 PREVIOUSLY: $3,398 TO $3,418

GAAP Net Loss $(721) TO $(704) PREVIOUSLY: $(674) TO $(631)

GAAP EPS $(4.50) TO $(4.40) PREVIOUSLY: $(4.22) TO $(3.95)

FY 2023 GUIDANCE:

SELECT FINANCIAL DATA

FISCAL YEAR 2023 GUIDANCE ($ in millions, except EPS)

FY 2023

REVISED GUIDANCE

($ IN MILLIONS)

FY 2023

PRIOR GUIDANCE

($ IN MILLIONS)

Net Bookings $5,200 TO $5,250 $5,400 TO $5,500

Recurrent Consumer Spending Growth

(RCS)

+85% YOY +90% YOY

Digitally-Delivered Net Bookings Growth +60% YOY +70% YOY

Non-GAAP Adjusted Unrestricted

Operating Cash Flow

OVER $400 OVER $650

We expect to deliver Net Bookings of $5.2 to $5.25 billion, which takes into account the current

economic environment and consumer purchasing trends we have been experiencing and we expect

to continue into Q4, including lower RCS and softer expectations for some of our recent game

releases, as well as the shift of an unannounced mobile title and a focus on enhanced profitability for

our hyper-casual business

• We have embarked on a cost reduction program that we believe can deliver over $50 million of

annual savings, which we will begin to execute on this quarter. Opportunities include personnel,

processes, infrastructure, and other areas, particularly in our publishing and corporate functions.

This is in addition to the $100+ million of annual cost synergies that we expect to realize from our

combination with Zynga, and is not expected to impact the delivery of our robust multi-year pipeline

• We continue to expect to deliver sequential growth in Fiscal 2024 and achieve record levels of

performance in the next few years

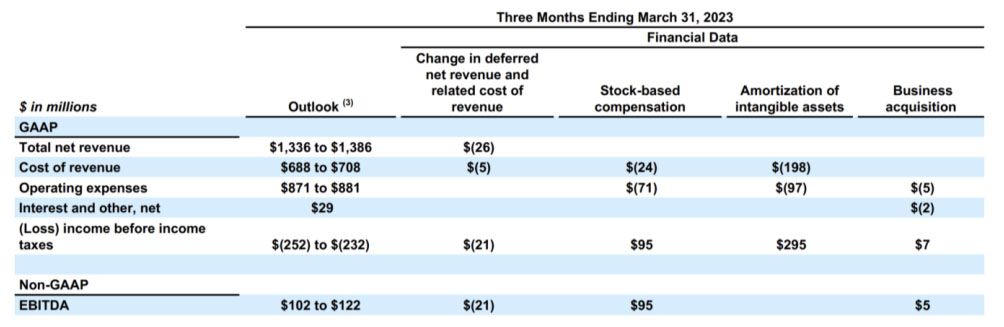

Q4 FY2023 GUIDANCE:

GAAP

Q4 FISCAL 2023 GUIDANCE ($ in millions, except EPS)

Q4 FY23 GUIDANCE

GAAP Net Revenue $1,336 TO $1,386

Operating Expenses $871 TO $881

GAAP Net Loss $(214) TO $(197)

GAAP EPS $(1.27) TO $(1.17)

Note: GAAP results are expected to be impacted by amortization of acquired intangibles and business acquisition costs

Q4 FY2023 GUIDANCE:

SELECT FINANCIAL DATA

Q4 FISCAL 2023 GUIDANCE ($ in millions, except EPS)

Q4 FY2023 GUIDANCE

($ IN MILLIONS)

Net Bookings $1,310 TO $1,360

Recurrent Consumer Spending Growth

(RCS)

+105% YOY

Digitally-Delivered Net Bookings

Growth

+70% YOY

We expect to deliver Net Bookings of $1.31 billion to $1.36 billion

• The largest contributors to Net Bookings are expected to be NBA 2K, Grand Theft Auto Online

and Grand Theft Auto V, Empires and Puzzles, Toon Blast, Rollic’s hyper-casual mobile portfolio,

and WWE 2K23

FY23-FY25 PIPELINE DETAILS

FY 2023 – FY

2025* TITLES ANNOUNCED TO-DATE

Immersive Core

Independent

Mobile**

(Titles in development &

soft launch)

Mid-Core

New Iterations

of Previously Released

Titles

24

• The Quarry (2K) – Launched June 10, 2022 (Fiscal 2023)

• NBA 2K23 (2K) – Launched September 9, 2022 (Fiscal 2023)

• PGA TOUR2K23 (2K) – Launched October 14, 2022 (Fiscal 2023)

• Marvel’s Midnight Suns (2K) – Launched December 2, 2022 (Fiscal 2023) (PS5, Xbox Series X/S, PC); TBA (PS4, Xbox One,

Switch)

• Kerbal Space Program 2 (Private Division) – Early Access Launching February 24, 2023 for PC (Fiscal 2023)

• WWE 2K23 (2K) – Launching March 17, 2023

• Judas (Ghost Story Games) – TBA

10

38

7

8

• Grand Theft Auto: The Trilogy – The Definitive Edition (Rockstar Games)

• Several Zynga titles in soft-launch, including Star Wars Hunters

• New Tales from the Borderlands (2K) – Launched October 21, 2022 (Fiscal 2023)

- FY23-25 release estimates provided as of May 16, 2022; however, mobile titles have been updated on August 8, 2022 to reflect Zynga. Full updated FY24/25 pipeline details to be given with Q4 FY2023 results.

** Mobile count excludes Rollic’s portfolio of hypercasual games. These titles are a snapshot of our current development pipeline. It is likely that some of these titles will not be developed through completion, that launch timing may

change, and that we will also be adding new titles to our slate.

PIPELINE DEFINITIONS

IMMERSIVE CORE

Titles that have the deepest gameplay and the most hours of content. Examples include our key sports franchises (e.g. PGA TOUR2K and

NBA 2K) as well as Grand Theft Auto and Red Dead Redemption (to name a few).

INDEPENDENT

Externally-developed Private Division releases.

MOBILE

Any title released on a mobile platform

MID-CORE

Titles that are either an arcade title (like WWE Battlegrounds) or games that have many hours of gameplay, but not to the same extent

as an immersive core title

NEW ITERATIONS OF PRIOR RELEASES

This includes ports and remastered titles. Sequels would not fall into this category.

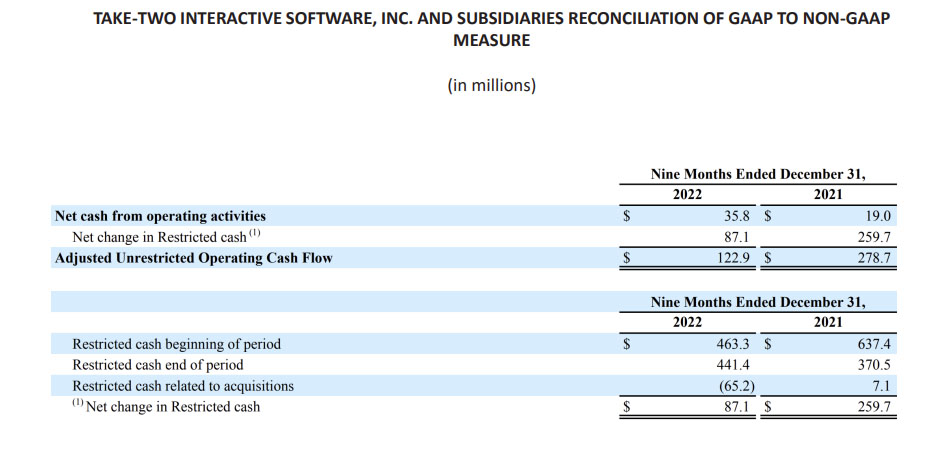

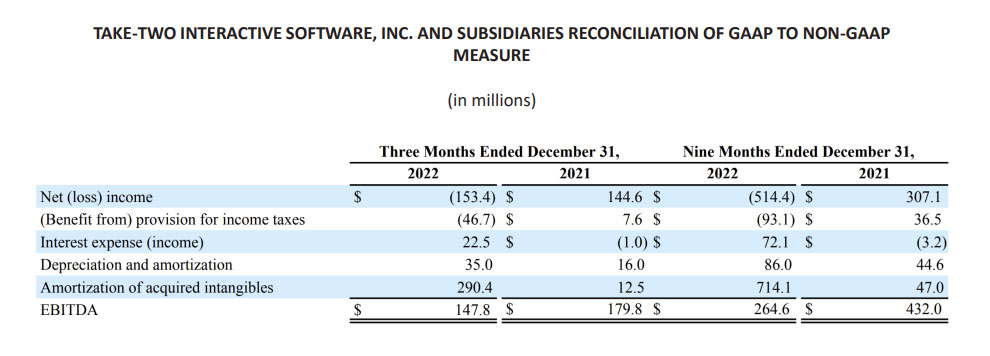

NON-GAAP FINANCIAL MEASURE

In addition to reporting financial results in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses Non-GAAP measures of financial performance:

Adjusted Unrestricted Operating Cash Flow, which is defined as GAAP net cash from operating activities, adjusted for changes in restricted cash, and EBITDA, which is defined as GAAP

net income (loss) excluding interest income (expense), provision for (benefit from) income taxes, depreciation expense, and amortization and impairment of acquired intangibles.

The Company’s management believes it is important to consider Adjusted Unrestricted Operating Cash Flow, in addition to net cash from operating activities, as it provides more

transparency into current business trends without regard to the timing of payments from restricted cash, which is primarily related to a dedicated account limited to the payment of

certain internal royalty obligations. The Company’s management believes it is important to consider EBITDA, in addition to net income, as it removes the effect of certain non-cash

expenses, debt-related charges, and income taxes. The Company has chosen to report EBITDA in light of the combination with Zynga, including the related debt financing.

Management believes that, when considered together with reported amounts, EBITDA is useful to investors and management in understanding the Company’s ongoing operations and

in analysis of ongoing operating trends and provides useful additional information relating to the Company’s operations and financial condition.

These Non-GAAP financial measures are not intended to be considered in isolation from, as a substitute for, or superior to, GAAP results. These Non-GAAP financial measures may be

different from similarly titled measures used by other companies. In the future, Take-Two may also consider whether other items should also be excluded in calculating these NonGAAP financial measures used by the Company. Management believes that the presentation of these Non-GAAP financial measures provides investors with additional useful

information to measure Take-Two’s financial and operating performance. In particular, these measures facilitate comparison of our operating performance between periods and may

help investors to understand better the operating results of Take-Two. Internally, management uses these Non-GAAP financial measures in assessing the Company’s operating results

and in planning and forecasting. A reconciliation of these Non-GAAP financial measures to the most comparable GAAP measure is contained in the financial tables to this press

release.

RECONCILIATION OF GAAP TO NON-GAAP MEASURE

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP

MEASURE

(in millions)

RECONCILIATION OF GAAP TO NON-GAAP MEASURE

TAKE-TWO INTERACTIVE SOFTWARE, INC. AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP

MEASURE

(in millions)

ГТА 5 онлайн работает в России и других странах. Теперь для компьютера можно купить Premium GTA Online и получить массу преимуществ от Rockstar Games в онлайн режиме GTA 5 и полное издание Grand Theft Auto V со всеми обновлениями и дополнениями. Супер!

Как только будут новости, мы расскажем вам про GTA 6, а сейчас следите за актуальными новостями по GTA 5 и GTA Online.

Видео Grand Theft Auto V

ГТА Онлайн в прямом эфире - Live GTA Online

GTA 5 Online Live

Лайв формат позволяет вам принимать активное участие в процессе и присылать свои донаты, как с вопросами и пожеланиями, так и просто в поддержку канала. Прямые эфиры ГТА 5 Супер проводятся на различных стриминговых площадках. Среди них: YouTube, Twitch, VK Play, Rutube, OK.

Подпишитесь на наш YouTube или Rutube и смотрите тысячи видео по игре плюс прямые эфиры.